Is Affordable Housing Really Affordable?

Nearly two-thirds of salary is spent on rental in Ealing and Hounslow boroughs

|

Every time a new tower block is proposed in London, the developer and councils talk about the number of new units that will be “affordable homes”.

But what does “affordable” actually mean? – and is it affordable at all?

With more than a quarter of Londoners now renting privately (up from 11% in 1990) and the average price of a one-bedroom flat in the capital costing more than a three-bedroom anywhere else in England, it’s an important question to ask.

Trying to get to grips with the different types of affordable home can be a minefield, not least because there are currently roughly six different categories.

To explain, we’ve summarised all the different types of affordable rankings, and what they mean.

Affordable Rent: Introduced by the government in 2011, these rents are typically set at 80% of the market value.

London Affordable Rent: Basically, London Affordable Rent is a non-binding target introduced by Mayor Sadiq Khan. They are not legal caps, and only really constitute benchmark targets. For 2017/18 these targets were £152 per week for a two-bedroom, and £161 for a three-bedroom property.

London Living Rent: Also introduced by Mr Khan, these rents are calculated at being a third of the occupant’s income, or according to the Mayor’s office, around two-thirds of market rents. The third-of-income is widely seen as the benchmark of an affordable renting situation for residents.

Social Rent: These rents are typically 50-60% of market rent, and are calculated on location and size of property.

Genuinely Affordable: This is a council term for traditional social housing, and relates to direct council tenants, whose rent is generally just over a quarter of market value. For example, a privately rented two bedroom home in the borough costs on average £334 a week, while the average weekly cost of a two-bed council home is around £99.

Shared ownership: This is a government funded product which you can access if you earn less than £90,000 a year, you’re a first-time buyer, you used to own a home, but can’t afford to buy one now, or you’re an existing shared owner. Essentially the scheme allows you to buy a share of the home and the landlord owns the rest, with rent charged on the landlord’s proportion. You can buy between 25% and 75% of your initial share and more at a later date if you can afford to.

According to Ealing Council, between 2005 and 2017 average private rents in the borough rose by almost 50%.

So, given that most new ‘affordable’ rentals being created today are set at 80% of the market rent – does this make them affordable?

According to Renters Rights London spokesperson Portia Msimang, it does not.

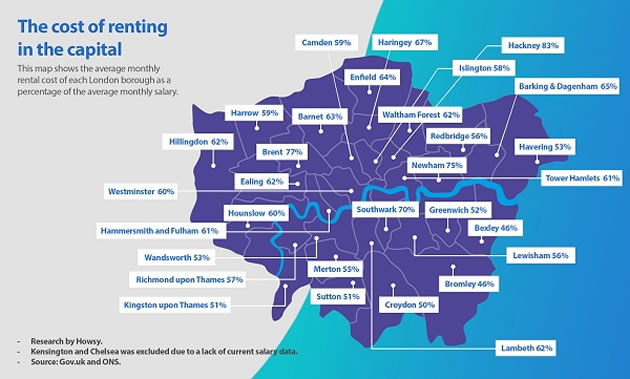

She pointed to research from Howsy Property Management which showed average rents in different London boroughs as a percentage of average salary.

The lowest percentages were seen in West London, in places like Bromley and Bexley, where rent gobbled up 46% of the average salary.

However, much of the rest of the city was around the 60 to 70% mark, with Hackney coming in at a whopping 83% of average income.

For West London, the average rent in Hillingdon and Ealing was 62% of average income, and in Hounslow it was 60%.

Ms Msimang said: “80% of that would still be well above the 33% of earnings that is considered the mark of adequacy.”

“So 80%, under the current terms of renting, under the current circumstances, of course it’s not affordable.”

A spokesman for Howsy said their map was based upon data from government and the Office of National Statistics.

He said: “Maximising your disposable income in any part of the UK is the key to living a happy life in the rental sector and it pays to do your research before making a move to ensure you can not only cover the cost of renting, but you aren’t left high and dry once you have.”

“These are the best areas to look to in order to do this, but we appreciate for those working in London, a commute from East Renfrewshire is probably a tad unrealistic.”

In July the Mayor’s Office released the a document called Reforming Private Renting: The Mayor of London’s Blueprint.

It contained a whole host of recommendations, including measures to improve security with tenancy reforms, new powers to control rent, and court reforms to make legal help more available to renters.

However, this was just a blueprint, and in many areas the Mayor doesn’t have the power to act on the plans.

A spokesperson for Mr Khan said: “We now need the Government to give the Mayor far more money and powers so that he and councils can truly turn London’s housing crisis around.

“Sadiq is using his funding and planning powers to cap rents for Londoners on low incomes at social rent levels.

“Last year, the Mayor started building nearly 4,000 homes with rents at this level or below.

“That is what most Londoners on low income need – not homes at 80 per cent of market rents.”

Ged Cann, Local Democracy Reporter

August 17, 2019